Independent vs. Big-Box Insurance Agencies: 5 Reasons We Serve You Better

Insurance isn’t just about policies—it’s about protection, peace of mind, and long-term financial security. Whether you’re looking for life insurance, health coverage, or retirement planning, choosing the right partner makes all the difference. But with so many options available, the question becomes: should you work with a big-box insurance agency or a local, independent advisor?

At Wampler Varner Insurance Group, we’ve been proudly serving families and businesses in Englewood and across Southwest Florida for more than 35 years. Let’s explore the differences between these two types of agencies—and why independence often works better for you.

What Are Big-Box Insurance Agencies?

Big-box insurance agencies are the national brands you see advertised everywhere—from TV commercials to stadium sponsorships. They’re large, recognizable, and often backed by a single, well-known insurance company.

Here’s what you can expect from them:

-

One-size-fits-all policies built for broad audiences.

-

Limited flexibility since they represent just one insurance carrier.

-

Call centers or online portals for customer service.

-

Heavy focus on sales quotas and new sign-ups.

While they’re convenient for quick quotes, they may not always provide the personalized solutions families and businesses truly need.

What Are Independent Insurance Agencies?

Independent insurance agencies—like Wampler Varner Insurance—are locally owned, family-run businesses that put people first.

Independent agencies offer:

-

Access to multiple insurance carriers, not just one.

-

Custom policies tailored to your unique needs and budget.

-

Face-to-face support and guidance from someone who knows you personally.

-

Long-term relationships built on trust and reliability, not just transactions.

The independence means agents act as your advocate, shopping the market to ensure you always get the best value.

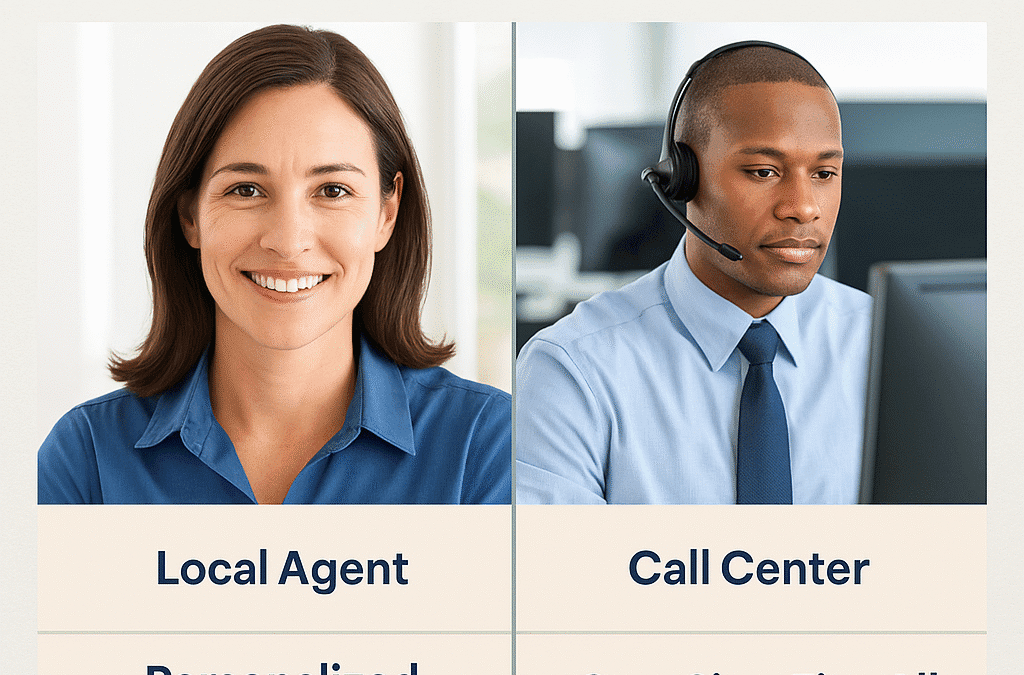

Key Differences: Independent vs. Big-Box

1. Choice and Flexibility

-

Big-Box Agencies: Limited to their own company’s products, restricting your options.

-

Independent Agencies: Can compare multiple carriers, giving you more flexibility.

2. Personalized Service

-

Big-Box Agencies: Customer service often runs through automated systems or national call centers.

-

Independent Agencies: Direct, local access to a trusted advisor who knows your history and priorities.

3. Claims Support

-

Big-Box Agencies: Claims often handled impersonally, with long wait times.

-

Independent Agencies: Serve as your advocate, guiding you through claims and ensuring fair outcomes.

4. Community Connection

-

Big-Box Agencies: Operate nationally, often with little involvement in local communities.

-

Independent Agencies: Invested in their hometowns, supporting local families, businesses, and charities.

5. Long-Term Relationships

-

Big-Box Agencies: Agents may come and go frequently, making consistency difficult.

-

Independent Agencies: Many clients work with the same trusted advisor for decades, across generations.

Why Independence Matters for Your Coverage

Life doesn’t stand still—and neither should your insurance. Independent agencies can easily adjust your coverage as your circumstances change:

-

Starting a family and needing life insurance.

-

Expanding your small business and adding group health benefits.

-

Preparing for retirement and exploring long-term care options.

As Investopedia explains, independent agents have the ability to “shop policies across multiple insurers to find the best combination of price and coverage.” That flexibility is a major advantage over big-box providers.

The Wampler Varner Insurance Difference

At Wampler Varner Insurance Group, we’ve built our reputation on three key assets that big-box agencies often can’t provide:

-

Personalized Guidance: We listen to your goals and design solutions just for you.

-

Generational Trust: Many of our clients have worked with us for decades, passing that trust on to their children and grandchildren.

-

Local Commitment: We’re not just your insurance advisors—we’re your neighbors, invested in Englewood and the greater Southwest Florida community.

Our services include:

-

Health Insurance (individual and family plans)

-

Life Insurance (term, whole, universal)

-

Group Employee Health Benefit Plans

-

Long-Term Care Insurance

-

Retirement Plan Coverage

👉 Learn more: Our Insurance Services

FAQs

Q1: Where is Wampler Varner Insurance located?

We’re at 31 W Green St, Englewood, FL 34223, proudly serving all of Southwest Florida.

Q2: How long have you been in business?

We’re a family-owned agency with 35+ years of experience.

Q3: What types of insurance do you provide?

We offer health, life, group benefits, retirement planning, and long-term care insurance.

Q4: Do you represent only one company?

No—we’re independent, which means we work with multiple carriers to find the best solutions.

Q5: How can I get started?

Call us at (941) 473-7100 or visit Wampler Varner Insurance Group to schedule a consultation.

Conclusion: Independence Puts You First

When comparing independent vs. big-box agencies, the difference comes down to one thing: who truly works for you.

Big-box agencies serve the company. Independent agencies serve you, the client.

At Wampler Varner Insurance Group, we’re proud to provide choice, personalized service, and trusted guidance to families and businesses throughout Southwest Florida. With more than three decades of experience, we remain committed to protecting what matters most to you.

📞 Call (941) 473-7100 today or visit Wampler Varner Insurance Group to see how independence makes the difference.